Whether you’re running an e-commerce site or merely selling anything on the web, you should provide your consumers with a reliable, fast, and simple method of making payments. Both your clients’ and your company’s demands must be met by the payment method you choose.

A reliable payment processing service is just as crucial to the success of an online store as any other factor. However, we must first comprehend what a payment gateway is and how it functions in order to select an appropriate payment system.

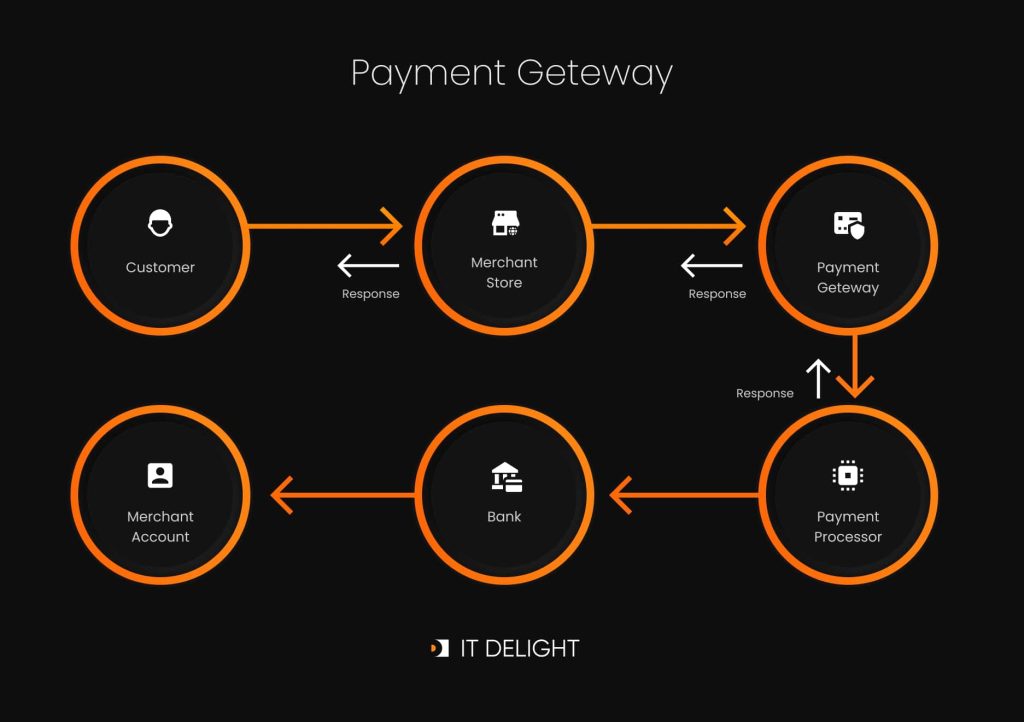

How Does a Payment Gateway Work?

The payment gateway serves as an intermediary between the client and the merchant, enabling smooth and timely completion of the transaction. Sensitive card data are managed safely by the gateway, which acts as a bridge throughout the processing of the payment.

Let’s explore a payment gateway’s functioning in more detail throughout the payment process.

- A consumer selects the item or service they wish to buy before going to the checkout page.

- On the secure payment page, a consumer provides their credit card or debit card information.

- Before sending the card information to the bank, a payment gateway tokenizes or encrypts the payment details and runs fraud tests.

- This data is transmitted to the card issuers in a safe way by the acquiring bank.

- The card schemes carry out an additional level of fraud screening before sending the payment information to the issuing bank.

- After doing a fraud check, the issuing bank verifies the operation. The acquirer receives an accepted or denied payment notification once it has been returned.

- The payment gateway delivers a message to the merchant after receiving the permission or refusal notification from the acquiring bank.

- Depending on the response, the retailer may either show a page for the consumer to confirm their purchase or request an alternative form of payment.

The aforementioned processes can all happen instantly or take around three seconds maximum.

What to Consider When Choosing a Payment Gateway Provider?

The level of competition among payment gateways increased alongside the need for them. So how do you pick one that will work well for your company? Here are some helpful pointers.

Pricing

The cost is always going to be one of your primary concerns when purchasing anything. The price of payment systems will fluctuate based on a variety of factors. For example, your business strategy, the forms of payment you take, monthly and yearly payments you get, and more.

Device compatibility

Depending on the nature of your business and your customer base, you may attract a wide range of people using a big variety of computers, smartphones, and tablets. While some payment gateways function flawlessly across all platforms, others display bugs. You should test the gateway’s functionality on many operating systems and platforms before making a final decision. Knowing the demographics of your website’s users beforehand is useful as well.

Customer support

Thousands of dollars pass through the accounts of businesses using payment gateways each day. Even an hour of downtime, let alone an extended length of time, might be quite damaging to such a corporation. In the event that something goes wrong, customer service must be accessible 24/7 with many ways to contact them.

Integration

The operation of a payment gateway is never independent. It’s a component of a system, and it’s your responsibility to ascertain how effectively your website platform integrates with the gateway you choose. Your website may run on a platform like Magento, WordPress, or even a completely unique one. Verifying that your platform is compatible with the integration is a first step. If an integration doesn’t function properly, your payment system will be buggy and might drive away clients. To make sure that the integration works perfectly, hire eCommerce development team experts.

Need a seamless payment integration?

Feel free to leave us your contact details and we’ll reach out to you

The Most Popular Payment Solutions

There are a plethora of gateway service providers, but we’ve narrowed it down to a few of the largest and most trustworthy ones.

PayPal

One of the most commonly used forms of digital payment in the world is PayPal. It provides scalable solutions for companies of all sizes. All major credit card issuers, debit cards, and PayPal transactions, along with a number of additional options, may be processed using PayPal’s payment gateway.

Additionally, it offers a variety of services like PayPal Express Checkout that provides a Paypal button to your website and PayPal Payments Pro with a built-in checkout .

Stripe

Stripe was designed specifically for use in online stores. All of the popular payment options, including mobile services like Apple Pay, Alipay, and Android Pay are accepted by Stripe.

All of the necessary components, including in-depth documentation, worldwide support, and a tracking system, are included in the solution. It offers 135 supported currencies, a streamlined PCI compliance process, and capability for interacting with various third-party systems.

2Checkout (now Verifone)

For companies of all sizes, 2Checkout (Verifone) offers customisable choices and integrated payment alternatives. Its capacity to scale with packaging for many product categories is its greatest benefit. All of the popular payment methods, 87 different currencies, and 15 localized languages are supported by this system.

Authorize.net

Authorize.net is recognized for its developer-friendly API and the freedom to deliver a unique, satisfying user experience. The gateway boasts of its sophisticated fraud detection suite for preventing recurring billing and financial fraud. Authorize.net is regarded as being exceptionally safe.

It allows for rapid transactions and the transmission of payments right away without placing a restriction on transaction amounts. This payment gateway offers several extra features, such as fraud protection and a straightforward checkout process. The main difference in billing is that in addition to the transaction costs, there is a set monthly fee.

Amazon Pay

Amazon Pay is increasingly overtaking PayPal as the preferred payment gateway host for small and medium-sized businesses thanks to its strong brand recognition. A robust fraud prevention solution is available to you with an Amazon Pay business account.

Unfortunately, this service is currently limited to the United States, the United Kingdom, and Germany. Because Amazon Pay is API-driven and user-friendly, the company has made available free plugins for use on a variety of e-commerce platforms.

Custom Payment Gateway

A payment gateway should make it simple, efficient, and secure for businesses to accept online payments. The safety of your customers’ financial information and personal details should be your first priority while developing a payment gateway. Although a custom payment gateway solution normally demands a larger time and financial investment, it will significantly aid your company’s growth and success. Undoubtedly, your consumers will be more inclined to deal with you if you have a reliable payment gateway.

Pros of developing your own payment gateway

Integrating a payment gateway that was created specifically for your company might be a strong asset. Here is what you can get:

Reduce payment gateway costs

In the long run, the fees and costs involved with using a standard payment gateway solution can eat up a significant percentage of your profits. By using your own payment gateway, you may avoid these ongoing charges and registration fees.

Benefit from the specific features

Finding a reasonably priced off-the-shelf solution may be difficult, and even then you may end up being constrained by limitations. For instance, you might be unable to execute some transactions if a third-party payment gateway does not enable recurring payments and multi-currency transactions. Using your own payment gateway, you may change it and add new features based on the demands of your company.

Selecting the Right Integration Method for Your Business

Generally, there are several primary approaches to integrating a payment gateway. And there are two main distinctions between each of them: how user-friendly the checkout and payment processes are, as well as whether you need to comply with any financial regulations (such as PCI DSS).

So let’s find out what your alternatives are and which integration strategies work best for you.

For what situations does PCI DSS compliance need to be in place?

This part can be skipped if all you need is a payment gateway and you don’t intend to retain or process credit card information. Your payment gateway or service provider will take care of all the processing and compliance requirements.

However, you’ll need to adhere to specific industry laws if you’re going to work with sensitive financial information. Handling card payments requires the Payment Card Industry Data Security Standard (PCI DSS). The four largest financial associations—Visa, MasterCard, American Express, and Discover — created this security standard in 2004.

Let’s examine the available integration methods and list their advantages and disadvantages. We’ll also discuss if PCI DSS compliance is required in each situation and which integration strategies work best for which kinds of organizations.

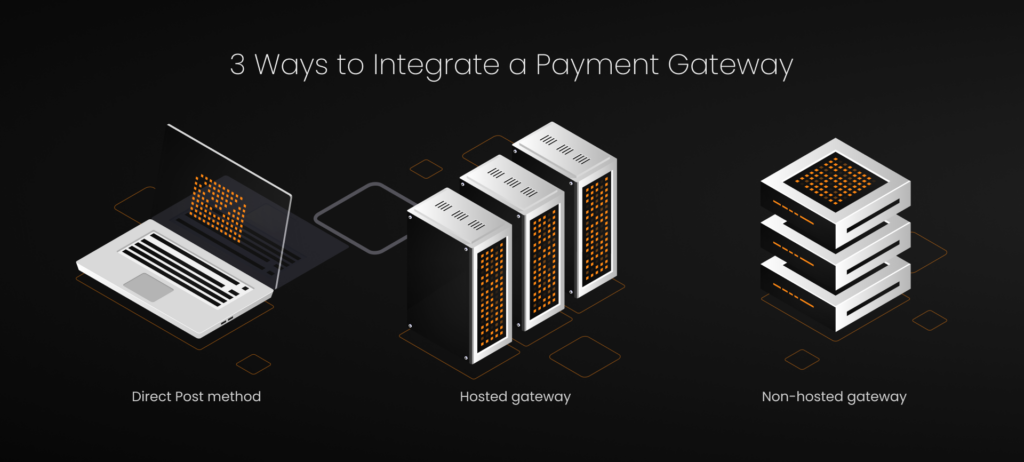

Hosted payment gateway

A hosted payment gateway is an independent third party that processes transactions on your behalf. Therefore, in order to make a transaction, your clients must exit your website. In short, a consumer is routed to a payment gateway web page to enter their card number in that scenario. After the consumer submits their payment information, they will be sent back to the store’s page. Here, the checkout is completed and the purchase approval is displayed.

The benefit of a hosted payment gateway is that the service provider handles all aspects of payment processing. The vendor also retains customer credit card information. Therefore, employing a hosted gateway allows rather simple integration and does not require PCI compliance.

The absence of control over a hosted gateway is one of the drawbacks. Customers might not have confidence in third-party payment methods. Additionally, diverting visitors away from your website reduces conversion rates and hurts your branding.

How to integrate: Integration guidelines are often available on the vendor’s websites, and the connection is made via an API. As an illustration, PayPal Checkout recommends integration using a Smart Payment Button. It’s just a line of HTML code that adds a PayPal button to your checkout page. Every time a user clicks the button, it calls the PayPal REST API to validate, gather, and submit payment information through a gateway.

This approach is good for companies of a small size or local scope that would rather not have their own payment processing infrastructure.

Direct Post method

Because PCI compliance is not required, Direct Post is an integration technique that enables a consumer to buy without leaving your website. When a buyer makes a purchase, the information about that transaction is expected to be submitted to the payment gateway immediately. Without being kept on your server, the data is sent directly to the gateway and processor.

Without PCI DSS compliance, you still have plenty of personalization possibilities. All required actions are also completed by the user on a single page.

The drawback of using Direct Post is that it’s not hundred percent secure.

For the integration, a supplier will have to establish an application programming interface (API) link between your shopping cart and its payment gateway. This method is appropriate for companies of any size.

Non-hosted gateway

The absence of third parties at the payment checkout step is essentially the definition of an integrated or non-hosted payment gateway. Businesses that use non-hosted gateways must achieve PCI DSS compliance, which implies they are in charge of keeping each transaction secure.

White label payment gateways can occasionally be used by businesses as a non-hosted alternative. Simply, this is a prebuilt gateway that can be altered and branded with your logo. The following are some popular white label products created for retailers: PayXpert, Akurateco, Hips, PayPipes, MasterCard.

With retailers becoming their own payment service providers when they achieve the essential compliance, a non-hosted gateway may be a dedicated source of income. What this implies is that you can charge other businesses a fee to handle their payments. However, being your own payment gateway provider has a technological burden in addition to the regulatory one since you require a secure infrastructure to hold transaction data, credit card numbers, and other sensitive information.

The advantage of this approach is that you are in complete control of your operations. Your payment service may be modified to suit your preferences and objectives as a business.

Non-hosted payment gateways are incorporated onto your server using APIs. Therefore, the integration will need to be done by an engineering team. The majority of suppliers provide developer blogs, API descriptions, and integration guidelines that are well-organized.

This method is best suited for medium-sized and large-scale companies that place a high priority on branding and customer experience. If you want us to integrate this method into your shop, check our About Us page first to learn more details about our expertise.

In conclusion

The market is saturated with ready-made online payment options. A crucial choice for expanding your business is selecting the appropriate provider. Adding a payment gateway to your online platform will offer your visitors a better user experience and the highest level of security. Many payment gateways are PCI-DSS certified and have security features like TLS encryption and two-factor authorization.

Get in touch with our developers if you want to build a payment-enabled website or incorporate a gateway into an existing product.